The New Payments Platform is set to release by the end of 2017 and has the potential to make some pretty cool changes to the Australian economy.

Currently in its final stages of industry testing, the New Payments Platform (NPP) is a new national payments infrastructure that will allow financial services and payments industries faster and simpler payments to both businesses and consumers. So what exactly is the NPP, how is it different to the technology already in the industry and what does this mean for businesses?

What is the NPP and How Does it Work?

The NPP is basically a new way of transferring funds for both consumers and businesses. It’s promising some really cool features, like real-time transfers and text or document attachments, that are going to make digital payments simpler, easier and faster.

Initially, the platform is being collaboratively developed by NPP Australia and 13 financial institutions, including the Commonwealth Bank of Australia (CBA), Westpac Banking Corporation (WBC), Australia and New Zealand Banking Group (ANZ), the National Australia Bank (NAB) and the Reserve Bank of Australia (RBA).

To break down some pretty complex processes and technologies, the NPP works through three important parts: the Basic Infrastructure, the Fast Settlement Service and the Overlay Services.

1. The ‘Basic Infrastructure’

The NPP’s Basic Infrastructure consists of a network, a switch and an Addressing Service. The network connects all the participants (the banks and finance institutions) and the switch basically moves messages between the participants via the network. The Addressing Service then allows transaction accounts to be identified across the network.

2. The Fast Settlement Service

The Fast Settlement Service (FSS) is provided by the Reserve Bank of Australia. This means that every single payment made on the platform, regardless of size, can be settled in real-time in central bank funds. This allows payments to be made across financial institutions prior to crediting of the payee’s bank account.

3. Overlay Services

One of the key parts of the Basic Infrastructure is that, as the name suggests, it’s an infrastructure on which additional products and services can be built. This means that ‘Overlay Services’ can leverage the network and functionality of the NPP while adding any additional features. The first Overlay Service to go live on the platform will be Osko by BPAY.

The NPP website has some pretty useful resources if you wanted to get a more detailed understanding of the technology and processes behind the Platform.

Benefits of the NPP to Businesses

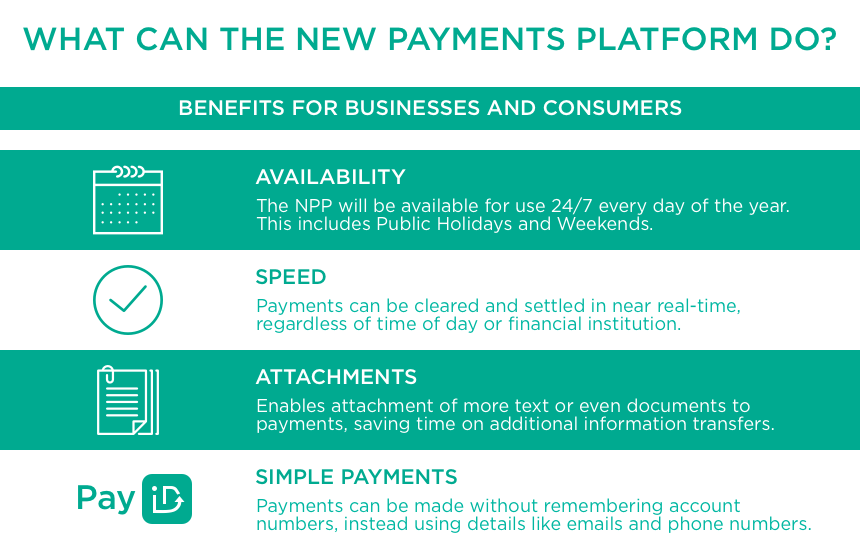

The main benefits of the New Payments Platform for businesses (and consumers) will come in the form of speed and availability, data-enriched payments and simple identification.

Any application built on top of the NPP will allow Australians to send money to any person or business in real time (including outside banking hours). The NPP will also let you identify your payee using their email address, telephone number or, in the case of businesses, an ABN. Similar technology is already being used in Sweden.

The New Payments Platform could be a huge win for small and medium businesses, increasing the speed at which they pay and get paid in return. Many business owners also don’t operate strictly within the 9 to 5 working week, usually having much more flexible working schedules. The NPP will be just as flexible as business owners, allowing them to make payments and continue working as they normally would, without having to wait for banks to catch up on payments during regular banking hours.

Business owners can also look forward to invoices being much easier to keep track of because the payments you receive from clients will be processed much quicker on the NPP. This will be particularly handy for retailers, as customers’ credit card payments will be processed into your business bank account instantly, rather than having to wait up to a few days for the transaction to clear.

This idea of real-time payments may seem too good to be true, but with so many of the major financial institutions already on board, the New Payments Platform could make it a reality by the end of the year.