Adding Moula Pay to your Xero invoices is easy

There’s more for you when you become a Moula Pay Merchant Partner. We’ve connected with Xero, so when you invoice your customers, they’ll have the option to pay with Moula Pay, right away.

Moula Pay in 3 simple steps

With Moula Pay, there’s a clear before and after

We partnered with Moula Pay before COVID and we’ve since seen a 20% increase in our closing rate. Our closing rate was previously around 70%, now we’re up around 90%. I get paid upfront, and my customers benefit from paying over time.

Samantha Firestone, Director – Firestone Digital

Merchant Partner FAQs

Start an application, and we’ll give you a call within 48 hours to finish the process. It’s that easy. We’ll go over a set of assessment criteria and quickly get you up and running.

With Moula Pay, there are no setup costs, ongoing fees, or lock-in contracts. Merchant service fees are charged per transaction, and dependent on your business. We’ll let you know your merchant service fee during the set-up process.

After becoming a Merchant Partner, you’ll get access to our Merchant Dashboard. From anywhere at any time, this will give you the ability to request payments, process refunds, and refer your business customers to Moula Pay. You’ll also get a clear picture of your customers’ transaction history.

You’ll have a single point of contact helping you build your business through Moula Pay. If you have any questions, your dedicated Account Manager is just a phone call away.

Log in to your account and go to Make a referral. This will bring up a form titled, Refer a new business. Once you’ve filled in your customer’s details, click Send new referral.

Remind your customer to check their email and follow the prompts to apply for Moula Pay. In terms of timing, we’ll contact them within 1 business day to follow up on their application, then they’ll be ready to go.

After logging in to your account, go to Process a refund. Fill in the transaction’s details before clicking the button, Process refund, to authorise the refund process. Once we receive the funds, we’ll credit your customer’s Moula Pay account within the month as a repayment, freeing up their available spend limit.

Plenty. Your business customers get up to 3 months free from interest and repayments, plus a spend limit of up to $250,000. They can use Moula Pay to get whatever their business needs within their allocated limit at any participating Merchant Partner.

Your customers can repay on their terms. If they repay during the interest-free period, within the first 3 months of making a purchase, they won’t pay any interest at all. Beyond that, an interest rate of 3% per month will be applied against their daily outstanding principal balance across the month.

Yep, you certainly can. In fact, every time you pay with Moula Pay, you’ll get up to 3 months free from interest and repayments. You can use Moula Pay at any other participating Merchant Partner, getting whatever your business needs up to a spend limit of $250,000. Learn more about Moula Pay for business purchases.

Moula Pay QR code payments allow you to get paid right away simply by displaying your QR code for customers to scan using their smartphone. You don't need any additional devices.

Adding your Moula Pay QR code to an invoice template is a straightforward process. We’ve created a set of guides to walk you through how to add a QR code to Xero, MYOB and Microsoft Word invoices. Learn more about creating invoices with Moula Pay QR codes.

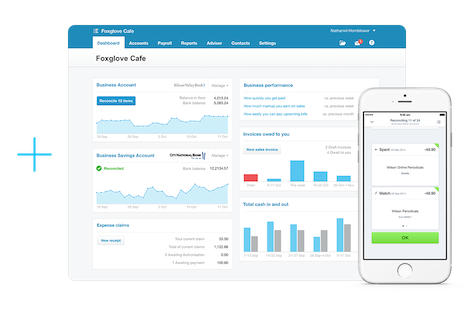

About Xero

Xero is world-leading online accounting software built for small business.

- Get a real-time view of your cashflow. Log in anytime, anywhere on your Mac, PC, tablet of phone to get a real-time view of your cash flow. It’s small business accounting software that’s simple, smart and occasionally magical.

- Run your business on the go. Use our mobile app to reconcile, send invoices, or create expense claims – from anywhere.

- Get paid faster with online invoicing. Send online invoices to your customers – and get updated when they’re opened.

- Reconcile in seconds. Xero imports and categorises your latest bank transactions. Just click ok to reconcile.

Find out more or try Xero Accounting Software for free.