For the vast majority of SMEs, the average debtor period is sitting at more 50 days and is only rising. This is having a serious effect on business cash flow.

Debtor periods (also known as collection periods) can have a huge impact on a business’ cash flow so monitoring and managing yours is key to healthy working capital management. Ongoing evaluation of outstanding collection periods directly affects a business’ cash flow and making sure your all your payment periods line up with your business’ operations is key to successful business management.

What Exactly is the 'Average Debtor Days'?

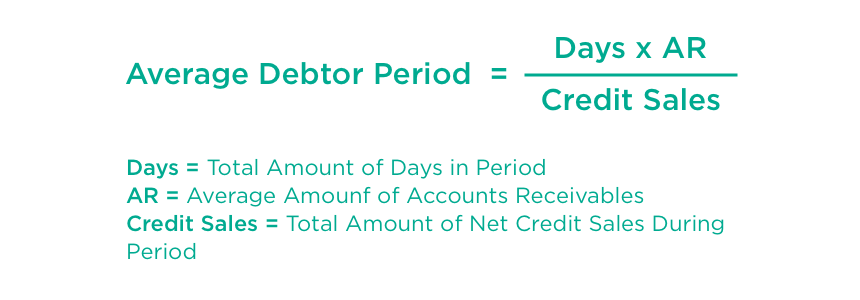

Before we dive in, here’s a quick refresher on average collection periods. The average debtor period (or collection period) is the amount of time it takes for a business to receive payments owed in terms of accounts receivable. This is calculated by dividing the average balance of accounts receivable by total net credit sales for the period and then multiplying that by the number of days in the period.

This basically represents the number of days between when the credit sale is made and when the payment is received. In general, a lower average collection period is better than a higher one as it indicates that a business is basically getting paid quicker.

The average collection period shouldn’t be looked at in isolation, however, and is best looked at over time so you can search for any trends and compare with other businesses or industry standards. Its also important to compare it to your credit terms you extend to customers – for example, an average collection period of 25 days isn’t too bad if invoices are issued with a 30-day due date.

The Rising Tide

It’s when the average collection period starts rising so high that it starts affecting your business’ cash flow and you have ‘gaps’ in payments that you need to start worrying. This is where it’s important to monitor your collection period so you know if and when your business will have a strain on its cash flow. The best example of this is if historically your business has a higher collection period during a particular time of year.

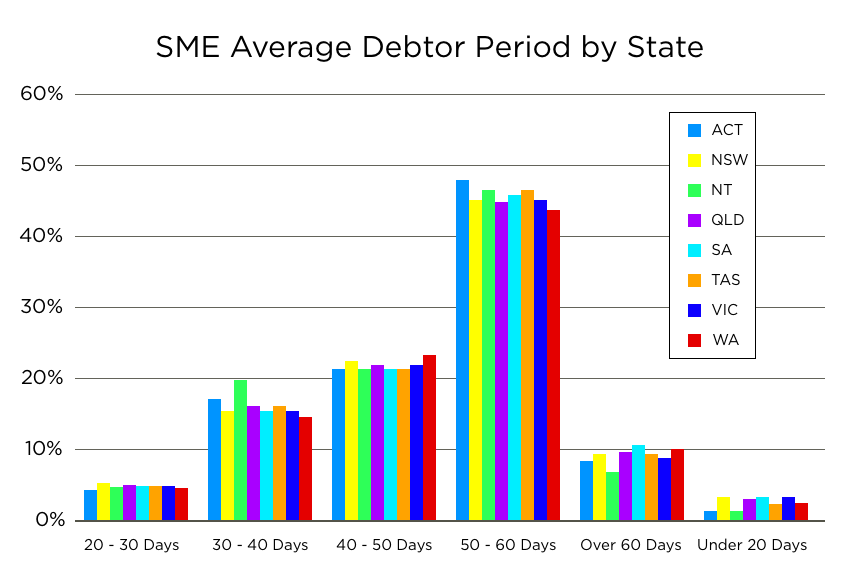

A recent report by Digital Finance Analytics surveyed 52,000 Small and Medium Businesses over the past 12 months and found that more than 50% of businesses had an average collection period greater than 50 days. This has increased year on year and has some serious effects on a business’ working capital.

This is also reflected in the stats around borrowing need for SMEs. Of the 60% of SMEs that are looking to borrow, working capital is by far the most significant driver. For many businesses, the overwhelming cause of the need for working capital relates to covering delayed payments. Rising debtor periods are having a negative impact on a business’ working capital ratio, and as a result, can hurt a business’ potential profits and growth.

How to Manage Your Debtor Periods

The first step to managing your business’ debtor periods is to monitor and evaluate any changes. If you can identify and isolate trends throughout the year, you will be able to prepare for these periods of delayed payment and bolster your working capital. The holiday season is where cash flow is most volatile, and average debtor days fluctuate significantly, particularly if you are a supplier or wholesaler. Xero surveyed all of their SME clients and found that more than 50% of all businesses operate in negative cash flow during December and January.

If you have evaluated your business’ payment periods and noticed an upward trend in debtor days, it may be an indicator that you need to revisit your payment terms. Disjointed debtor periods can have a serious effect on your business’ working capital and cash flow. Ensure that your invoicing terms and collections processes and align well with your business needs and your payment cycles to maximise positive cash flow.

However, there may be cases where you know your payments are going to be delayed or will usually come through in bulk after a busy period. For these times, you can plan your finances to make sure your sail through. Many businesses use short-term working capital loans to cover daily operations and keep things running smoothly until their payments come through. A flexible business loan with fortnightly repayments may give you a more stable cash flow so that you don’t have to tighten the belt of your business’ growth when you’re waiting to get paid.