Amortisation is a common accounting practice that is used to reduce the book value of a loan or an intangible asset over a stipulated period of time.

Two ways of applying amortisation

Amortisation, by definition, can apply in two different ways. First, paying off a debt by making regularly scheduled payments to cover both the principal and interest of a loan is called amortisation (also loan amortisation). The reduction of the current loan balance is shown in an amortisation schedule. Making monthly payments towards a car loan or mortgage are typical examples of this schedule.

Second, amortisation can also mean the spread of capital expenses that are related to intangible business assets over a specified period. Usually, they are spread across the estimated useful life of an asset. This technique is quite helpful for taxation and accounting purposes but not the same as loan amortisation.

The word amortisation comes from the Latin admortire which means ‘to kill’. In effect, you are ‘killing’ a debt or expense over time when you amortise it.

The relationship between loan amortisation and amortisation schedules

As mentioned, the process of paying off the entire debt by the maturity date by making regular payments (which can be monthly, fortnightly, weekly, or another interval) to cover principal and interest through regular payments is called amortisation.

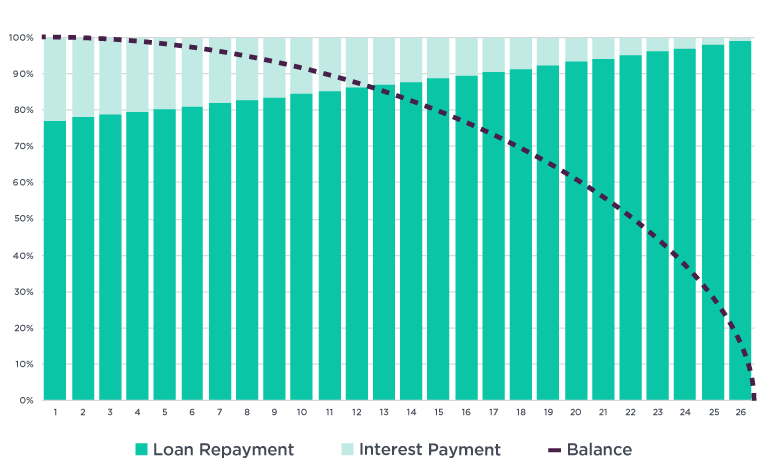

When it comes to business loans, a more significant portion of the monthly payment initially goes towards interest. But subsequently, these payments cover more of the loan principal. With many financial calculators available online, it’s fairly easy to calculate amortisation. Moula offers a business loan calculator that creates a payment schedule with loan amortisation. Here’s another amortization calculator that lets you choose the loan term, payment frequency and other factors.

The outstanding balance of a loan is the basis for preparing amortisation schedules. If repayments are made on a monthly basis, you can calculate the interest rate by dividing the existing loan balance by 12 months. Deducting the total monthly payment from that month’s interest payment will give you the total principal due for that month. If you want to calculate the next month’s outstanding balance on the loan, you need to deduct the most recent principal payment from the outstanding balance of the previous month.

The interest rate is, however, is calculated based on the new outstanding loan balance. This pattern continues until the entire loan is paid off by the loan maturity date.

Business loan example

Here’s an example of a Moula business loan with a principal of $20,000, an interest rate of 1% per fortnight, a term of one year and fortnightly repayments. The amortization schedule shows how much the total payment will be each fortnight and the portion of interest and principal for each payment. The total interest paid over the loan term is $2,812. The total payment due each fortnight remains the same, $877.38. The portion towards interest goes down each period as the principal decreases. While the first interest portion of the payment is $200, the final interest portion of the payment is $8.76.

| Fortnightly Period | Loan Repayment | Interest Payment | Total Repayment |

|---|---|---|---|

| 1 | $677.38 | $200.00 | $877.38 |

| 2 | $684.15 | $193.23 | $877.38 |

| 3 | $691.00 | $186.38 | $877.38 |

| 4 | $697.91 | $179.47 | $877.38 |

| 5 | $704.88 | $172.50 | $877.38 |

| 6 | $711.93 | $165.45 | $877.38 |

| 7 | $719.05 | $158.33 | $877.38 |

| 8 | $726.24 | $151.14 | $877.38 |

| 9 | $733.51 | $143.87 | $877.38 |

| 10 | $740.84 | $136.54 | $877.38 |

| 11 | $748.25 | $129.13 | $877.38 |

| 12 | $755.73 | $121.65 | $877.38 |

| 13 | $763.29 | $114.09 | $877.38 |

| 14 | $770.92 | $106.46 | $877.38 |

| 15 | $778.63 | $98.75 | $877.38 |

| 16 | $786.42 | $90.96 | $877.38 |

| 17 | $794.28 | $83.10 | $877.38 |

| 18 | $802.22 | $75.16 | $877.38 |

| 19 | $810.25 | $67.13 | $877.38 |

| 20 | $818.35 | $59.03 | $877.38 |

| 21 | $826.53 | $50.85 | $877.38 |

| 22 | $834.80 | $42.58 | $877.38 |

| 23 | $843.15 | $34.23 | $877.38 |

| 24 | $851.58 | $25.80 | $877.38 |

| 25 | $860.09 | $17.29 | $877.38 |

| 26 | $868.62 | $8.76 | $877.38 |

| Total | $20,000.00 | $2,811.88 | $22,811.88 |

Straight-line amortisation

With straight-line amortisation, the interest on a loan is distributed equally over all monthly payments until the debt expires. Some banks and financial institutions follow this method. When calculating a straight-line amortisation schedule, it’s important to consider all aspects, including the interest rate. The biggest consideration is your ability to make the scheduled loan repayments.

Amortisation of intangibles

Amortisation of intangibles is another common accounting practice. Projecting the cost of an intangible asset over the estimated useful life is one way to reduce tax liabilities. This helps you to measure the value of an intangible asset such as a patent, goodwill and copyright. Calculating depreciation of tangible assets and calculating amortisation is almost the same. Regarding financial statements, amortisation and depreciation appear under non-cash expense under a company’s income statement. Learn more about intangible assets.